Transformar Vidas, essa é a Força de Quem Faz Medicina na FAME Barbacena – Vestibular 2021.02

)

Faça sua Pré-inscrição para o Vestibular FAME 2022

With a Wave Pro subscription, you’ll have recurring billing and other automation features. Schedule everything, from invoice creation and invoice sending, to payment collection and overdue payment reminders. The Wave app lets you easily generate and send invoices to your clients wherever and whenever you need to. Sign up for Wave and send your first invoice right away—it only takes a few minutes! With the Pro Plan you can also set up recurring payments, auto-reminders, and deposit requests to make sure you always get paid on time.

Wave Financial Inc

Import, merge, and categorize your bank transactions. Easily create, customize, and send professional invoices while on-the-go. The rate that you charge for your freelancing services can https://www.quick-bookkeeping.net/ vary, so it’s important to get a grasp of market trends before sending your clients an invoice or quoting a price. Freelance rates can differ depending on experience level and industry.

Pocket- and small business-friendly perks

70,000 soldiers and 100 tanks might be able to stop a “special military operation” on these isles, but would be insufficient for a fight on continental Europe. According to Labour, a properly-funded military will only come when the “economic conditions allow”, which the Kremlin will surely read as an invitation to ensure said conditions are never reached. Promises to grow the economy are all well and good, but the security of the country is of paramount importance, especially when our Russian enemy has made its hatred for us clear. “High temperatures make it harder for the body to cool itself and we all need to take care to manage the health risks of heat,” William Spencer, the climate and first aid product manager at the British Red Cross, said. But the warmer weather will be a welcome change from the first few weeks of June, which have been relatively cool, with temperatures lingering in the teens.

Manage yourmoney like a boss.

Wave has helped over 2 million North American small business owners take control of their finances. Wave has helped over 2 million small business what happens when depreciation is not added back to cash flow owners in the US and Canada take control of their finances. Britain is in a position of strength thanks to Trident’s awesome repelling power.

Every invoice paid means more revenue coming into your small business. Create and send professional invoices to your customers in seconds. When everything is neatly where it belongs, tax time is simple.

Ready to invoice in style, bookkeep less, and get paid fast?

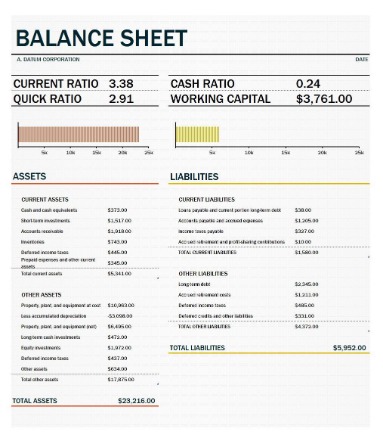

Have an eye on the big picture so you can make better decisions. Our accounting reports are easy to use and show monthly or yearly comparisons, so you can easily identify cash flow trends. Transactions https://www.business-accounting.net/total-manufacturing-cost-how-to-calculate-total/ will appear in your books automatically, and you can say goodbye to manual receipt entry. Email invoices with a secure “Pay Now” button after you’ve enabled the online payments option.

Be your own accountant, thanks to Wave’s automated features, low cost, and simple interface. Online payments allows you to get paid quickly by bank deposit, credit card, and Apple Pay. Know when an invoice is viewed, becomes due, or gets paid, so you can take the right actions to manage your cash flow. Set up invoice reminders to automatically email your customers when payment is due.

Your deposit times may vary based on your financial institution. All payments are subject to a risk review and periodic credit risk assessments are done on business owners because we need to cover our butts (and yours). A 1% fee is applied to the amount you withdraw from your available balance (minimum fee of $1), in addition to regular processing fees..

Manually creating invoices in Microsoft Word or Excel can be time-consuming and difficult to manage. Digital invoicing empowers your small business by automating invoice processing and saving time by tracking key invoice data like upcoming and outstanding invoices. You can also manage late payments more efficiently through e-invoicing by setting up payment reminders to send to your customers before an invoice due date. Set up recurring invoices and automatic credit card payments for your repeat customers and stop chasing payments. With Wave, your invoices and payments automatically flow into your accounting records.

- With a Wave Pro subscription, you’ll have recurring billing and other automation features.

- With Wave, your invoices and payments automatically flow into your accounting records.

- Switch between automatic and manual billing whenever you want.

- A common issue when invoicing in Microsoft Word, Excel, or other DIY solutions is making calculation errors.

- Give your customers the option of paying with one click using a credit card, bank transfer, or Apple Pay.

With Wave’s Pro Plan, you can set up recurring invoices and automatic credit card payments for your repeat customers. Switch between automatic and manual billing whenever you want. Wave invoices are integrated with our free accounting software, so payments are recorded and categorized for you – which means less bookkeeping and tax season prep.

Get paid in as fast as 1-2 business days1, enhance your brand, and look more professional when you enable Payments.Accept credit cards, bank payments, and Apple Pay for as little as 1%2 per transaction. You can mark invoices paid on the spot, so your records are instantly up to date. Accept payments through credit cards and bank payments to get paid even faster, for a low, pay-per-use fee. With Wave’s web-based invoicing software, you can create and send invoices for your business in just a few clicks from your computer. All you need is an Internet connection and a browser! If you’re on-the-go, you can also send invoices from your phone or other mobile device using the Wave app.

Wave uses real, double-entry accounting software. We built our payroll tool for small business owners, so it’s easy to use AND teaches you as you go. You’ll receive the money in your account in 1 business day (Canada), or 2 business days (US)1. Customers can pay instantly by credit card or Apple Pay when they view the invoice online.

You can accept credit cards and bank payments for as little as 1%2 per transaction. Approval is subject to eligibility criteria, including identity verification and credit review. Payments are a pay-per-use feature; no monthly fees here!